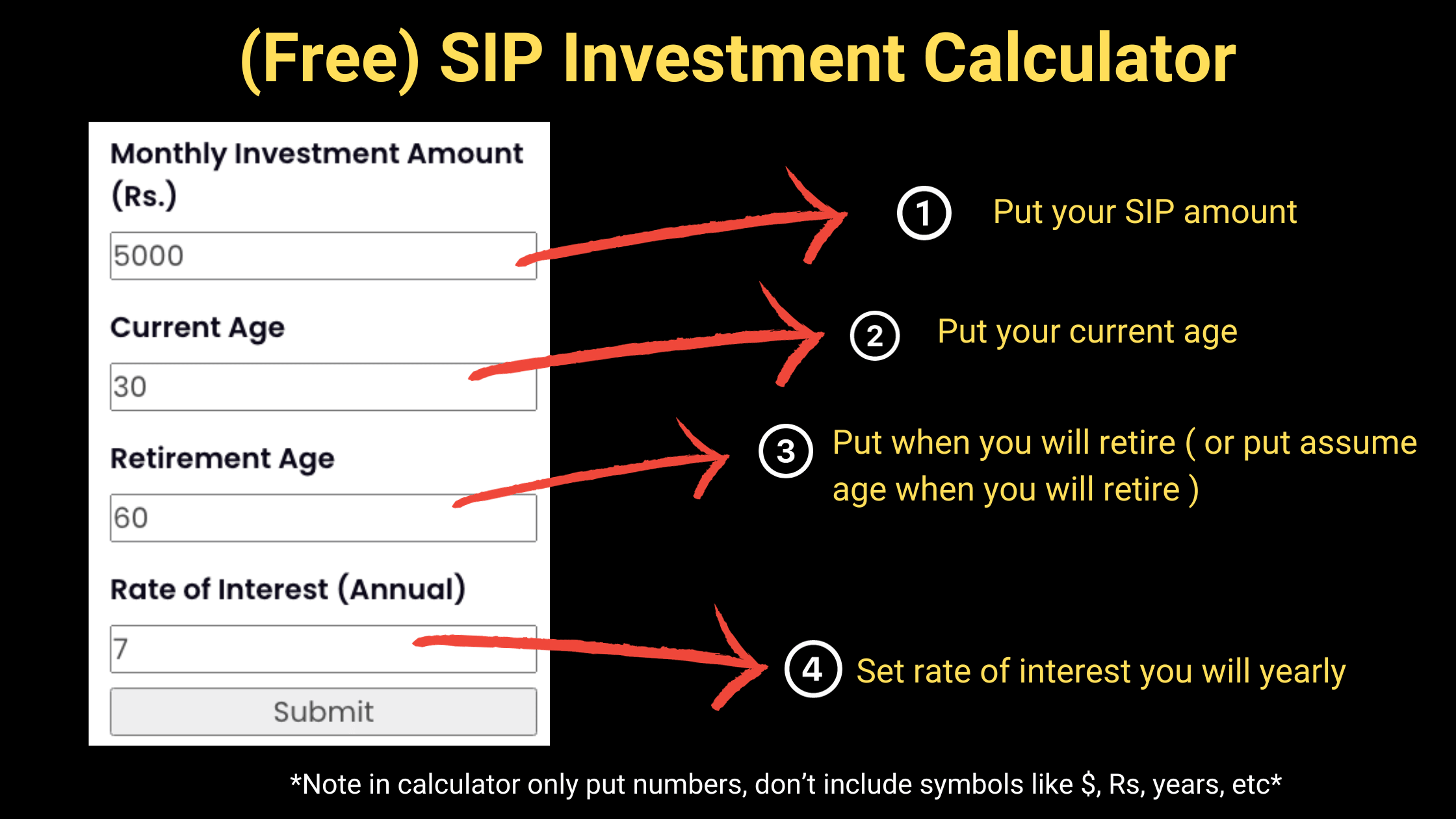

SIP investment calculator: Put monthly SIP > Current age > Retirement age > Rate of Interest.

[WP-Coder id=”12″]

Explore more Free Finance tools / Explore our free Finance & Stock Market courses

Investing wisely requires a strategic approach and access to the right tools. One such indispensable tool for investors, especially those leaning towards mutual funds, is the SIP Investment Calculator.

In this article, we will delve into the intricacies of this tool, understand how it functions, and learn how to make the most out of it for planning our investments.

Understanding SIP and Its Significance

Systematic Investment Plan (SIP) is a popular investment route that allows individuals to invest a fixed amount regularly in mutual funds.

It promotes disciplined investing and takes advantage of the power of compounding, making it a preferred choice for long-term wealth creation.

Why SIP Investment Calculator?

With keywords like “mutual fund return calculator,” “monthly sip calculator,” and “mutual fund investment calculator” gaining popularity, there is an evident surge in the demand for tools that can simplify investment planning.

This is where the “best sip calculator” comes into play. It is designed to give potential investors a clear picture of their investment journey, helping them make informed decisions.

SIP Calculator: Your Financial Planning Companion

What is it?

The SIP Calculator is a specialized tool designed to help you estimate the future value of your investments made through Systematic Investment Plans in mutual funds.

How does it work?

The SIP Calculator operates based on a set of input values and uses the compound interest formula to derive various results, including:

- Monthly Investment Amount: The amount you plan to invest every month.

- Current Age: Your age at the start of the investment.

- Retirement Age: The age at which you wish to reap the benefits of your investment.

- Annual Rate of Interest: The expected rate of return on your investment.

From these inputs, the calculator derives:

- Future Value of the Investment.

- Total number of years invested.

- Total amount invested.

- Total earnings from the investment.

How to Use the SIP Calculator?

Utilizing the SIP Calculator is straightforward. Follow these steps:

- Input your monthly investment amount.

- Enter your current age.

- Specify the age at which you plan to retire.

- Set the expected annual rate of return.

- Click “Submit” to view the detailed results of your investment.

Example:

Let’s consider an example to illustrate how the SIP Calculator works:

- Monthly Investment Amount: Rs. 5000

- Current Age: 30 years

- Retirement Age: 60 years

- Annual Rate of Interest: 7%

Upon entering these values and hitting “Submit,” the SIP Calculator will provide a comprehensive report, showcasing:

- Future value of your investments at age 60.

- Number of years your money was invested.

- Total amount invested over the years.

- Total earnings from the investment.

Benefits of Using SIP Calculator

The SIP Investment Calculator serves as a vital tool for investors, offering clarity and precision in financial planning. It enables users to gauge the potential growth of their investments, helping in crafting a sound investment strategy for the future.

Conclusion

Investing in mutual funds through SIP is a journey that demands careful planning and foresight. The SIP Investment Calculator emerges as a crucial tool in this journey, empowering investors with the ability to predict their investment growth and make decisions backed by data.

So, harness the power of this tool, plan your investments wisely, and watch your wealth grow over time. Remember, a well-informed investor is a successful investor!